Bari, Italy, 9th October 2024 – Auriga, the global software provider for omnichannel banking and the payments industry, today announced a new powerful data analytics tool for collecting, analysing, and forecasting operational and business performance across all banking service channels. As an integral part of its omnichannel banking solution suite, the new WWS INSIGHT module is designed to transform how banks and independent ATM deployers understand how their self-service banking channels (ATM and ASST) and other services being used by customers are performing.

In the search for differentiation in an increasingly competitive financial landscape data analysis is a critical tool. With the right capabilities, information on the performance of active channels can be transformed into targeted strategies to improve services.

With few available analytics tools having the rich feature set and capabilities needed to fully analyse omnichannel banking performance, Auriga is introducing WWS INSIGHT as a purpose built tool for understanding and interrogating the performance of customer facing banking channels.

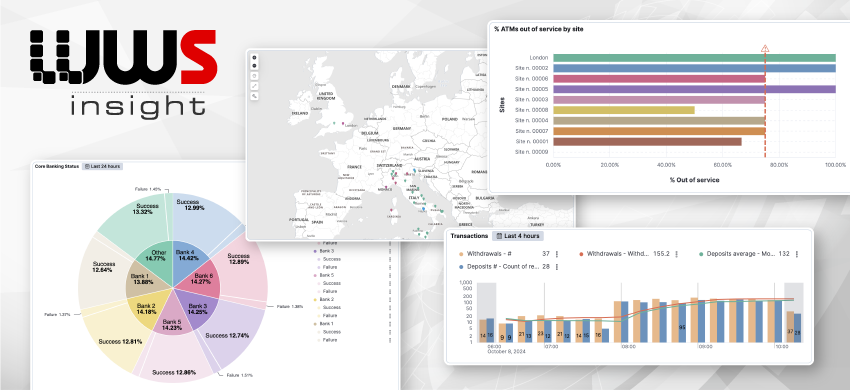

The tool provides a highly user-friendly and intuitive interface which enables both the operations staff and the line of business teams to have easy access to multiple performance indicators and data visualizations. These can be used to identify and support strategies that increase profitability, improve service performance and push down operational costs.

WWS INSIGHT offers banks a comprehensive, dynamic, real time view and assessment of the performance of their self-service banking channel and infrastructure based on a complete mapping

of the network. Teams can use the tool to set up forecasts of the performance of one or more services, and apply specific analysis parameters, depending on strategic indicators and business objectives. There is flexibility to set alarm parameters on issues like SLA deviation, performance anomalies and other issues. Additionally, they can define automatic and periodic reporting.

Brendan Thorpe, Customer Success Manager, Auriga said:

Simply collecting data is not enough. You need to be able to ask for and get analytical insights that can reveal true performance indicators and spot and understand challenges and obstacles in detail fast. Helping our customers become much more data driven is why we built WWS Insights and integrated it within our omnichannel banking and payment solution. The kind of insights that banks and ATM operators will be able to glean from WWS INSIGHT will be transformative in how they will have the most accurate, detailed, and timely data to improve profitability, service performance and reduce operational costs quickly.

WWS INSIGHT is available immediately as part of the WinWebServer (WWS) software suite which is a proven and modular solution that provides feature-rich banking services through all channels including mobile, tablets, PCs, kiosks, and ATM machines.

The new module can take data feeds from any device or system without impacting service performance and availability.

For information about Auriga’s PR activities and to receive our press kit:

Contact the Communication Department

IT

IT  ES

ES