CREATING THE NEXT GENERATION SELF-SERVICE BANKING PLATFORM

ATM must behave like any other digital channel in the current market. However, issues to maintain self-service banking competitive are several.

To answer those needs, how can physical and digital channels merge in a highly secure and modernized technology platform?

Auriga explains in this infographic how to create the next gen self-service experience and the main related benefits.

Read the infographicSELF-SERVICE BANKING – WHAT’S NEXT?

Explore the revolution of self-service banking!

Discover how Auriga and ACI Worldwide have partnered to support traditional banks staying competitive, solving cost pressure issues and building better relationships with their customers through the self-service channel.

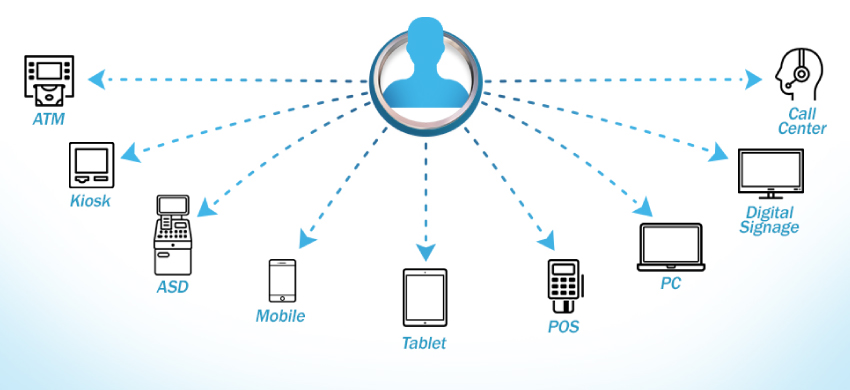

Read the infographicTHE CASE FOR FIs ADOPTING AN OMNICHANNEL MANAGEMENT AND MARKETING SYSTEM

Deliver a truly integrated digital strategy within bank is not an easy process.

Which are the main features for a successful omnichannel management & marketing system and which benefits must be considered by banks?

How many banks already have a single omnichannel management system? How many on the other side still leverage vertical silo systems?

Those and much more questions are addressed in this infographic. Find out more.

Read the infographic

IT

IT  ES

ES