Shared banking infrastructure of ATM networks or banking hubs is a business model that we support and make possible with our digital self-service and ATM as-a-Service solutions. This model could help banks who must ensure physical access to cash and banking services even as customer preferences move towards cashless payments and operational costs rise. Major

Shared infrastructure like ATM networks or branches can help maintain physical access to cash and financial services in communities that are at risk of losing their local bank branch or ATM. As we know from our work with Batopin, the ATM pooling initiative for Belgian banks, shared banking infrastructure can enable investment in modern self-service

At the ATMIA’s Europe and Emerging Markets 2024 conference, Brendan Thorpe, Customer Success Manager at Auriga spoke to Robin Amlôt, Managing Editor at IBS Intelligence and host of the IBSi Podcast about the importance of intelligent data management in the ATM and banking industry. In this podcast, Brendan explores why it is so important for

ATM jackpotting continues to be a threat to banks. This month a new report reveals that North Korean hackers are using a new Linux variant of the FASTCash malware to trigger unauthorized cash withdrawals. Auriga, which provides multivendor management and specialist cybersecurity for bank devices including ATMs and ASSTs, believe banks can protect themselves against

Our presence in the Polish market continues to grow this year. Auriga Poland has worked with our technology partner, Transaction Systems (TRsys), a major international technology solutions provider helping financial and retail organizations embark on their journey towards digital transformation, to achieve certification from the National Bank of Poland for a high-performance GRG Banking cash

Even though customers have moved towards cashless payments in recent years, more people are starting to rely on cash again as cost of living pressures increase. So, access to cash is more important now than ever before. But, accessing cash is becoming increasingly difficult as bank branches are disappearing on high streets across the UK.

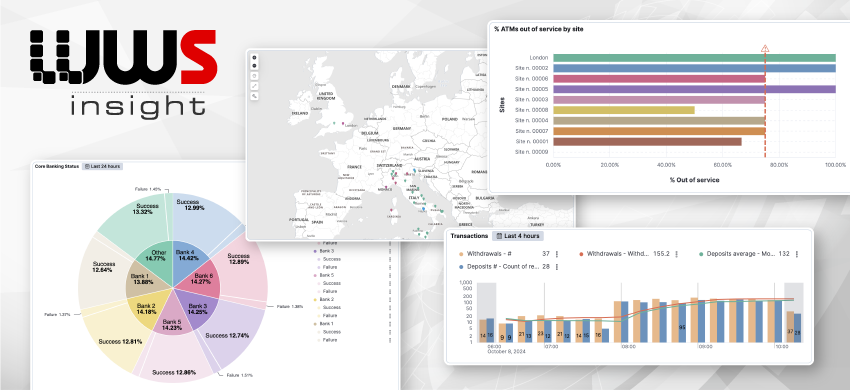

Bari, Italy, 9th October 2024 – Auriga, the global software provider for omnichannel banking and the payments industry, today announced a new powerful data analytics tool for collecting, analysing, and forecasting operational and business performance across all banking service channels. As an integral part of its omnichannel banking solution suite, the new WWS INSIGHT module

Today, September 18th, marks an important day in how one country, the UK, responds to customer concerns over the loss of bank branches and ATMs in their communities. From this the date the UK’s financial regulator, the Financial Conduct Authority, formally applies its new powers to regulate how banks shutter bank branches and cut ATM

With the Financial Conduct Authority closing the consultation on how banks manage branch and ATM closures and whether the guidance on these matters should be chanced, Auriga examined the situation and shared its perspective on what could happen next. For a substantial number of people, indeed, having access to in-person banking services is still crucial

This year’s ATMIA’s Europe and Emerging Markets 2024 conference and exhibition is coming to London’s Royal Garden Hotel from 9th October to 10th October 2024. The event will be advocating for cash, ATM security and payment choice for customers. It will also bring together an array of stakeholders from the global ATM industry, including financial

IT

IT  ES

ES